Featured in

Innovation Award

Unseen Business Award

Best Sustainable Investment Education Initiative

Sustainable Investment Award

PayTech for Good

PayTech Award

Technology Innovation of the Year

European Risk Management Awards

A Human Trafficking Documentary

Caught in the Light

Human trafficking generates hundreds of billions in illicit proceeds each year. It’s one of the most profitable predicate crimes – just behind drug trafficking and fraud. And it’s growing. Cases of human trafficking increased 28% in 2024, according to a UNODC report.

To shine a light on this urgent issue, we are proud to present Caught in the Light – a groundbreaking human trafficking documentary exploring how financial institutions are fighting this heinous crime. Featuring insights from industry experts, survivors, and advocates, the film highlights the crucial role banks play in detecting and disrupting trafficking operations.

Financial crime detection is broken

$3.1 trillion in illegal transactions were made in 2023. More than $800 billion was connected to drug trafficking, $350 billion to human trafficking, and $11.5 billion to terrorism. Another $500 billion was lost to fraud.

Less than 1% of these crimes are stopped.

That feels like an error of focus. Not an error of ability.

$350 billion

More than a third of a trillion dollars is generated each year by human trafficking.

50 million

There are more than 50 million people trapped in modern slavery.

<1%

Less than 1% of financial crimes are stopped.

Research report

Banks think they are 8 months behind criminals

New research by the RedFlag Accelerator reveals banks think they are 8 months behind criminals.

That’s according to 300 anti-fraud and AML professionals at US banks.

Some of the largest institutions believe the gap could be as wide as 23 months.

However, they’re confident they can catch up.

27%

Over a quarter of banks blame internal governance as the main reason banks are so far behind.

23 months

Most banks think criminals are around 8 months ahead of the banks, with the largest institutions believing the gap is as wide as 23 months.

57%

More than half of banks believe AI will make it more difficult to detect financial crimes.

A comprehensive source

How can the RedFlag Accelerator help?

The RedFlag Accelerator is the world’s most comprehensive source of contextual persona-based typologies. We help AML vendors and anti-fraud teams to:

Know where to start

The RedFlag Accelerator consolidates typologies, personas, and red flags for AML predicate offences into a single source.

Know what to look for

The RedFlag Accelerator gives visibility over the data by indicating what to look for, where to look, and explains what you see.

Take action

With full visibility and practical indicators, the RedFlag Accelerator enables banks, AML vendors, and law enforcement to generate high-quality alerts, conduct investigations, and provide training.

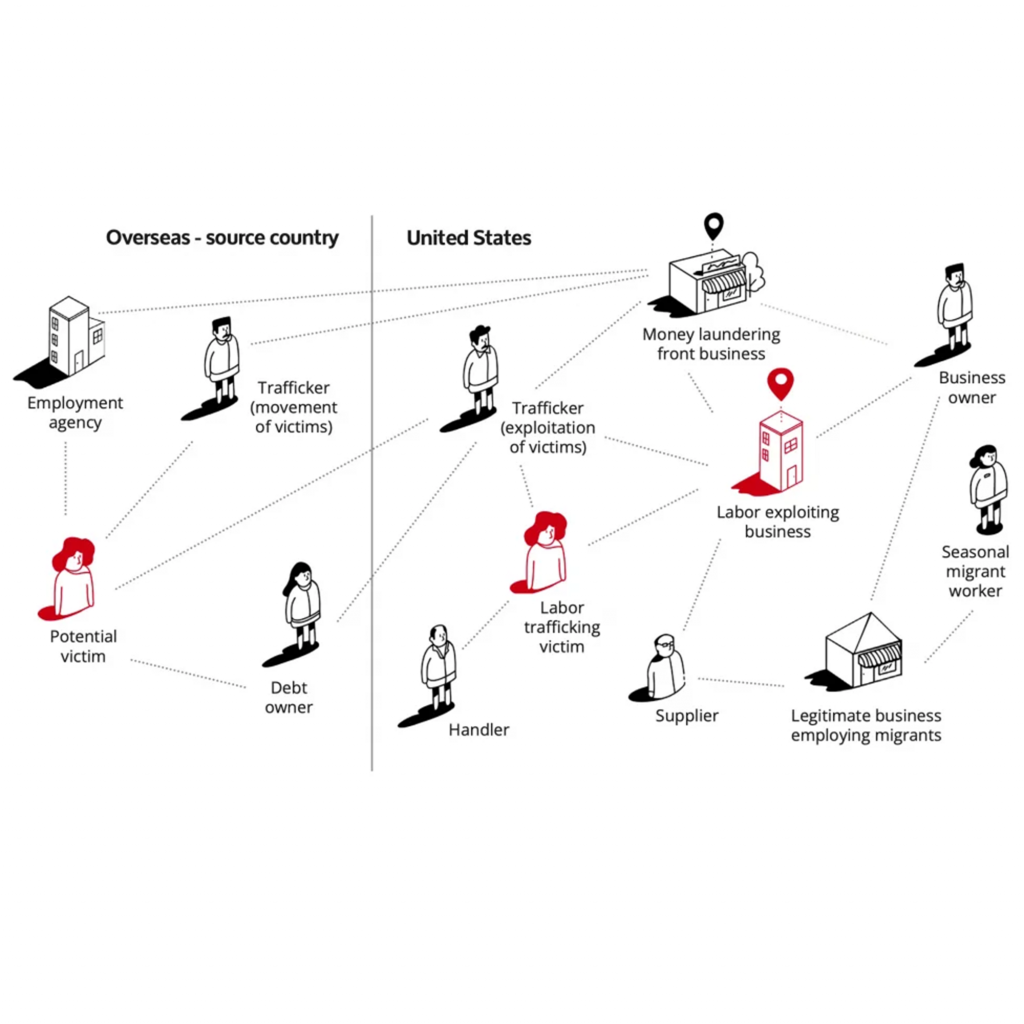

A persona-based approach

How it works

We’ve compiled scenarios based on hundreds of trusted intelligence sources to build the red flags for perpetrators, victims, money launderer personas, and everyone in between.

Persona-based approach

Our ground-breaking approach identifies behavioral patterns found across individuals involved in specific criminal business models.

Analytics

Persona-centric analytics embedded in your AML tools offer an efficient and effective alternative to rules-based detection.

How you benefit

Improved detection

Utilize the latest personas, typologies, and red flags to enhance your ability to detect and investigate financial crimes.

Regulatory compliance

As financial crime regulations around the globe are increasing, we help you stay compliant.

Reduced risk exposure

Gain the knowledge needed to quickly identify the latest threats and high-risk behaviors in your customer data.

Data-driven insights

We continuously update our database to keep up with rapidly evolving criminal business models.

We know payments

Why choose the RedFlag Accelerator?

We’ve helped some of the biggest banks on the planet solve their payments problems.

We exist to help open the doors of finance to all and to protect those who enter. We enable good payments and help stop the bad.

22+

years in payments and technology

24

countries

200+

years of combined banking experience

500+

successful implementation projects