Human trafficking (HT) has been widely researched and discussed in different forums and from different perspectives. Most recently, ACAMS Today’s brilliant three-part series, “Understanding Human Trafficking,”1 clarified key HT concepts, definitions and business models that are useful for every anti-financial crime (AFC) professional to understand.

This new series summarizes key challenges with current HT financial investigations and explores how persona-based typologies and methodology can accelerate and improve the detection and investigation of these crimes.

Why Persona-based Typologies Matter

A new person in the world becomes an HT victim every four seconds. HT is not only one of the biggest injustices of our time, but it is also one of the most widespread financial crimes in the world, estimated to be worth at least $150 billion a year.2 As long as illicit gains from buying and selling people continue to flow through legitimate financial systems undetected, everyone can and must do more, and the financial sector has a key role to play.

As one of FinCEN’s National Anti-Money Laundering Priorities,3 HT remains one of the key challenges for AFC professionals. In fact, banks provide access to the payment rails used for transferring underlying illicit money, in addition to having a huge amount of data, which, if analyzed, can uncover HT risks, providing the evidence needed to disrupt these crimes.

Criminal techniques exploited by traffickers are becoming increasingly sophisticated and banks’ ability to spot and stop illicit activities is declining, which can be observed through banks processing huge amounts of illegal profits hidden in plain view, as proven by recent fines paid by banks. In 2020, a large Australian bank was fined a record $900 million for anti-money laundering (AML) breaches that enabled online child sexual exploitation, while a major European bank was fined $100 million for failure to spot red flags when dealing with Jeffrey Epstein (an American sex offender and financier).

However, despite growing awareness, increasing fines, as well as an avalanche of new or amended regulations and spending hundreds of billions of dollars4 a year on financial crime compliance, the world has not come any closer to moving the needle. In fact, there are more slaves today (50 million5) than at any other time in history. The detection and prosecution rates of HT remain low.6 To date, less than 1% of traffickers are prosecuted and a fraction of survivors are rescued7 each year.

Key Challenges

The above statistics clearly illustrate that the current approach to tackling HT is flawed and needs profound refactoring. The key challenges that banks are facing include insufficient time and resources, trouble with pacing and the complexity of change in regulations and in the traffickers’ business models, as well as having a highly fragmented approach within banks and across the industry.

Furthermore, the issues previously listed are exacerbated by an ineffective incentive model conducting a “box-ticking” compliance culture, often leading to blind spots in threat exposure and potential impact, as well as limited transaction monitoring rules that do not reflect relevant typologies and red flags. Often, the key issues boil down to a lack of understanding of what to look for in high volumes of financial data to find signs of HT.

It is critical to recognize that HT behaviors often fall outside the typical AML ruleset. It may show up in lower-value payments, seemingly innocent purchases or transacting with countries that are not known to be at high risk for money laundering. However, to spot suspicious activities, many transaction monitoring approaches still rely on rule-based alerts and scenarios built on thresholds or known generic money laundering risk factors. This approach proves to be insufficient to detect the constantly evolving criminal behaviors, resulting in potential high-quality alerts being overlooked amid the high rates of false positives.

What Is a Persona-based Approach?

No one red flag in isolation can reveal complex crimes such as HT. Therefore, the detection and investigation approach should be tailored to consider relevant red flags in context. Research is showing positive signs that persona-based typologies and detection models can be an effective alternative to current rule-based detection models.

The key concepts detailed below need to be considered when developing persona-based typologies and models. Graphic 1 shows an example of the actors involved in the HT chain.

Graphic 1: The HT Chain

Visualization by Silvija Krupena

1) Know Your Criminals

Understanding and accounting for norms in legitimate behaviors and criminal behaviors are the key to success. Personas enable the behavioral patterns that can be found across multiple individuals or organizations with similar traits to be revealed. As illustrated in Graphic 1, within any given HT business model, multiple actors exist and interact, such as trafficker, facilitator, recruiter and victim. Each actor can have multiple roles and personas.

2) Understand the “Haystack”

A persona is a contextual representation of real-life behaviors that, when combined with available data, paints the full picture. It is very important to understand what data can be accessed for a model to work. The best results can be achieved with a combination of intelligence-led models supported by machine learning or artificial intelligence (AI) to embed the detection. However, even without complex machine learning or AI, banks can achieve transformational results by moving from unstructured rules to organized clusters of risk factors aggregating behaviors of known personas.

Solutions

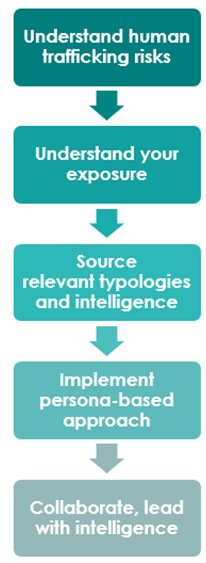

There are many steps ranging from quick and simple to complex and technical that can help banks to start moving in the right direction. Some key activities include those in Graphic 2.

Graphic 2: Key Activities in the Fight Against Human Trafficking

Visualization by Silvija Krupena

1) Understand HT Risks

HT comes in many different shapes and forms. Business models vary significantly across different trafficking types (sex trafficking, forced labor, child sexual exploitation, etc.) and geographies. It is incredibly important to first understand these crimes to be able to address them.

2) Understand Your Specific HT Exposure

This assessment helps to select appropriate and targeted controls and tools that fit your business model, products and customers. A generic approach does not work to tackle this crime.

3) Outsource Relevant HT Typologies

Outsource relevant HT typologies and other intelligence by leveraging resources readily available in the market. These include law enforcement and regulatory guidance,8 UN/FAST Blueprint,9 OSCE Following the Money10 Compendium, the Financial Action Task Force (FATF) Human Trafficking Typologies, the FATF Financial Flows from Human Trafficking,11 RedFlag Accelerator typologies12 and many others.

4) Implement a Persona-based Approach

Work with your transaction monitoring team or vendor to move from simple rules and scenarios to a contextual persona-based approach. This can significantly reduce the noise and help identify actors and networks potentially involved in HT instead of flagging stand-alone transactions or behaviors.

5) Collaborate

This global issue cannot be solved in silos. Traffickers have no borders, no budgets to consider and no data protection concerns. Participating in private-public and other partnerships,13 and exchanging intelligence and the latest trends is vital to help everyone be better equipped.

The financial sector can lead by example by combining these activities to have a powerful impact and disrupt HT. To do this, the financial sector must act, cooperate and leverage existing intelligence, data and technology. Most importantly, it is time to move away from outdated and rigid responses toward a more proactive and effective approach.

Conclusion

It is more urgent than ever to act as global armed conflicts rise and the cost of living increases the risk of vulnerable populations being trafficked and exploited. The problem will only get bigger unless meaningful changes are made and fast. It is disheartening to witness the uphill battle that traffickers and other criminals keep winning. We can all do more. Knowing what to look for is a good place to start and understanding how to find it can change the game.

In the next article, we will dive into the details of persona-based typologies and methodology with practical examples of how to adapt and implement them.

Silvija Krupena, CAMS, head of FIU, RedCompass Labs, silvija.krupena@redcompass.com, ![]()

- Chris Bagnall and Sara Crowe, “Understanding Human Trafficking,” ACAMS Today, April 19, 2022, https://www.acamstoday.org/understanding-human-trafficking/

- “ILO says forced labour generates annual profits of US$ 150 billion,” International Labour Organization, May 20, 2014, https://www.ilo.org/global/about-the-ilo/newsroom/news/WCMS_243201/lang–en/index.htm

- “FinCEN Issues First National AML/CFT Priorities and Accompanying Statements,” Financial Crimes Enforcement Network, June 30, 2021, https://www.fincen.gov/news/news-releases/fincen-issues-first-national-amlcft-priorities-and-accompanying-statements

- “2022 True Cost of Financial Crime Compliance Study,” LexisNexis, 2022, https://risk.lexisnexis.com/global/en/insights-resources/research/true-cost-of-financial-crime-compliance-study-global-report

- “Global Estimates Of Modern Slavery: Forced Labour And Forced Marriage,” International Labour Organization, September 12, 2022, https://www.ilo.org/global/topics/forced-labour/publications/WCMS_854733/lang–en/index.htm

- John Cusack, “Human Trafficking Cases—Prosecutions and Convictions Analysed by FCN,” Financial Crime News, October 28, 2022, https://thefinancialcrimenews.com/human-trafficking-cases-prosecutions-and-convictions-analysed-by-fcn/

- Calculated using data from the ILO and the U.S. Department of State. “Trafficking In Persons Report 2022,” U.S. Department of State, July 2022, https://www.state.gov/wp-content/uploads/2022/10/20221020-2022-TIP-Report.pdf

- Financial Crimes Enforcement Network advisories search, Financial Crimes Enforcement Network, https://www.fincen.gov/resources/advisoriesbulletinsfact-sheets/advisories

- “The Blueprint,” Finance Against Slavery and Trafficking, https://www.fastinitiative.org/the-blueprint/

- “Following the Money: Compendium of Resources and Step-by-Step Guide to Financial Investigations Related to Trafficking in Human Beings,” Organization for Security and Co-operation in Europe, October 2019, https://www.osce.org/files/f/documents/f/5/438323_0.pdf

- “Financial Flows from Human Trafficking,” Financial Action Task Force, July 2018, https://www.fatf-gafi.org/media/fatf/content/images/human-trafficking-2018.pdf

- RedFlag Accelerator homepage, RedFlag Accelerator, http://redflagaccelerator.com/

- “Compendium of Promising Practices on Public-Private Partnerships to Prevent and Counter Trafficking in Persons,” United Nations Office on Drugs and Crime, 2021, https://www.unodc.org/documents/NGO/PPP/UNODC-PPP-Interactive.pdf

Share this post

Written by

Silvija Krupena

Director of Financial Intelligence Unit

Resources